Denver First Time Home Buyer & Down Payment Assistant Programs

First Time Home Buyer & Down Payment Assistant Programs

Buying your first home is daunting. The process seems big and complicated and the purchase price seems even bigger! For the vast majority of people, a home is the most expensive purchase in their life. In Denver, we feel that high purchase price more acutely than people in other markets. Thankfully, an aspiring home owner doesn’t have to pay 20% down on a home. You can get into a house for 3-5% down, but 5% of $500,000 is still a lot of money! Thankfully there are several home buyer programs available to residents in the Denver Metro Area that help people overcome the hurdle of getting into a home and the benefits of home ownership. Below I have outlined some of my favorites.

CHFA

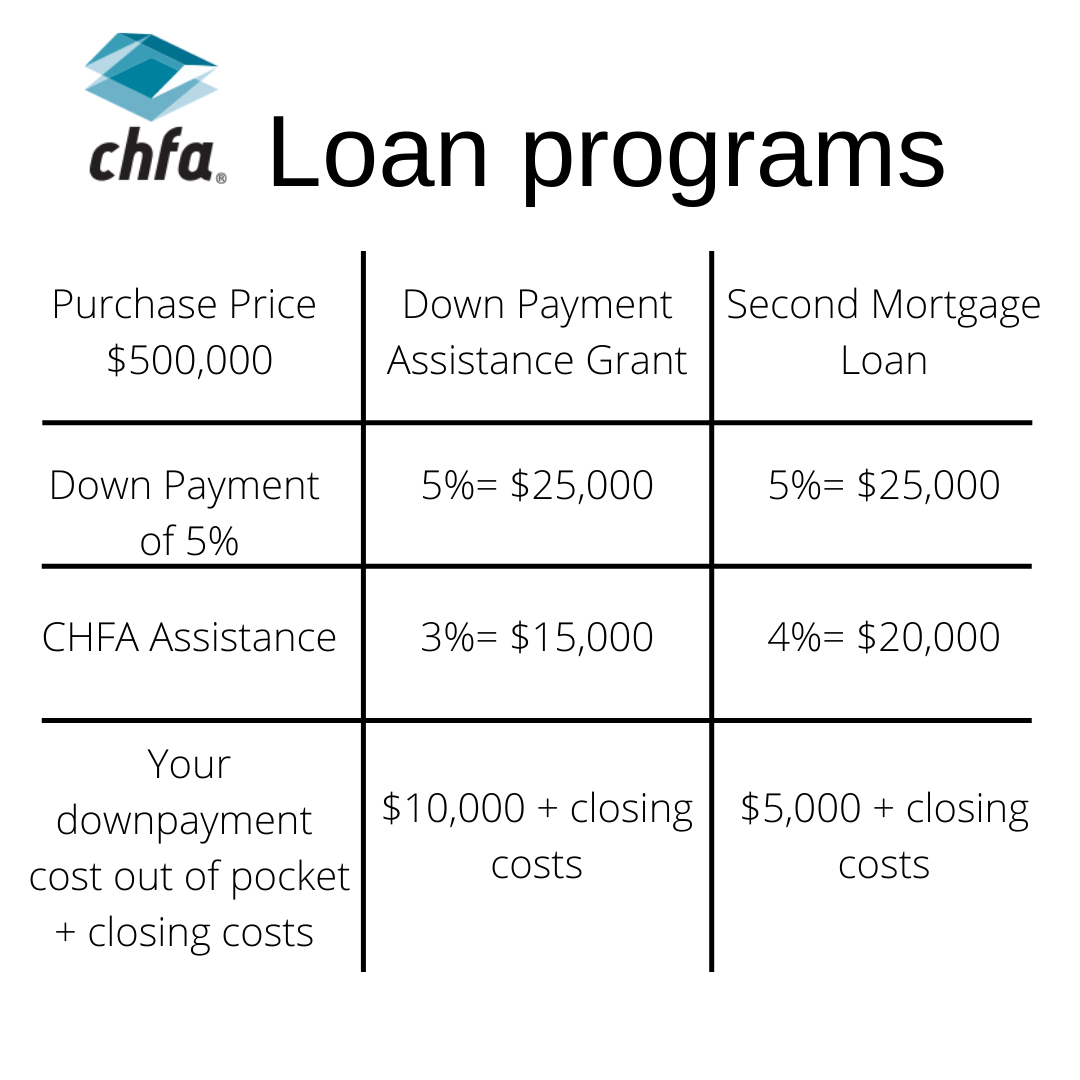

CHFA’s home loans and grants are well known products in the Colorado home buyer community. It is probably the most accessible because so many lenders have access to it. Depending on your income and qualifications CHFA offers either The Down Payment Assistance Grant (you don’t have to pay back) of up to 3% of the purchase price of a home, or The Second Mortgage Loan of up to 4% of the purchase price (that you do have to pay back once you sell or refinance). If a loan is only requiring you to bring a 3.5% or 5% down payment, the cash out of your own bank account to get into a home goes down dramatically using these programs as illustrated.

My wife and I used CHFA to get into our first home. We qualified for the Second Mortgage Loan, bought a home for $358,000, and when the dust settled we only had to come out of pocket about $2,500.

Click here to check out more info about CHFA and their qualifications.

NACA

NACA, the Neighborhood Assistance Corporation of America, is truly an incredible organization. Although I have only been familiar with it for a few months, I love the benefits and mission of NACA. They are a nonprofit that fights for economic justice by helping individuals and families get into homes who normally wouldn’t qualify or be able to afford a traditional purchase loan product. Honestly, the the terms of NACA’s purchase program sound too good to be true! I had to do some digging to verify everything, but it checks out! Here are some of the benefits:

Two additional benefits not listed above are -

1) They don’t look at credit score but rental history. This helps so many would be home owners who could afford a mortgage payment, but lenders won’t finance, because they had a hard stretch, or missed a student loan payment years ago, and have bad credit as a result.

2) No PMI - On almost any loan that you don’t put 20% down on, the borrower will have to pay private mortgage insurance, which is an insurance that doesn’t protect you, but the lender. It is generally 0.05% of the principle and interest, which in the Denver Metro can easily add $100-300 to a monthly payment. The fact the NACA offers a no PMI product is mind blowing!

Getting qualified for a NACA loan is an involved process, but is obviously worth it for all of the benefits and for those who couldn’t otherwise get into a home. Check out NACA’s website for more information.

Bank of America

Big banks were first hand contributors to the financial/housing crisis of 2006-2009. Deemed “to big to fail” and bailed out by the government, banks were required by federal lawmakers to pay penance in some ways such as setting up funds/programs to “give back” in order to make up for some of the harm they caused. In light of this Bank of America has set aside a huge fund where they give grants to qualifying home buyers. They give up to $10,000 in down payment grants, and up to $7,500 in closing cost grants, totaling up to $17,500 in free money for home buyers. While giving back, they still make much more money than they give on loan origination, selling off the mortgage, or on the loan’s interest if they hold it, but hey, it’s the thought that counts right? 😏

Like the other programs, buyers have to meet certain qualifications and the grants only apply in certain areas. Check out the link for more info!

Interested in one of these products or want to learn more? Give me a call at 501.827.0764 or email me at ryan@rr-services.co and I can give more information and get you connected to the right loan professional to get the process started.

By Ryan Williams